What is Bitcoin halving? Imagine you have a magic candy-making machine that produces special candies. This machine gives you 10 candies every hour as a reward for keeping it running smoothly. The machine makes it slightly harder to operate every few hours, so you get fewer candies as a reward; instead of 10 candies every hour, you only get 5 candies.

That’s because the machine had a “halving” event it reduced the number of candies it gave you by half. But don’t worry; the machine keeps making candies at a slower rate.

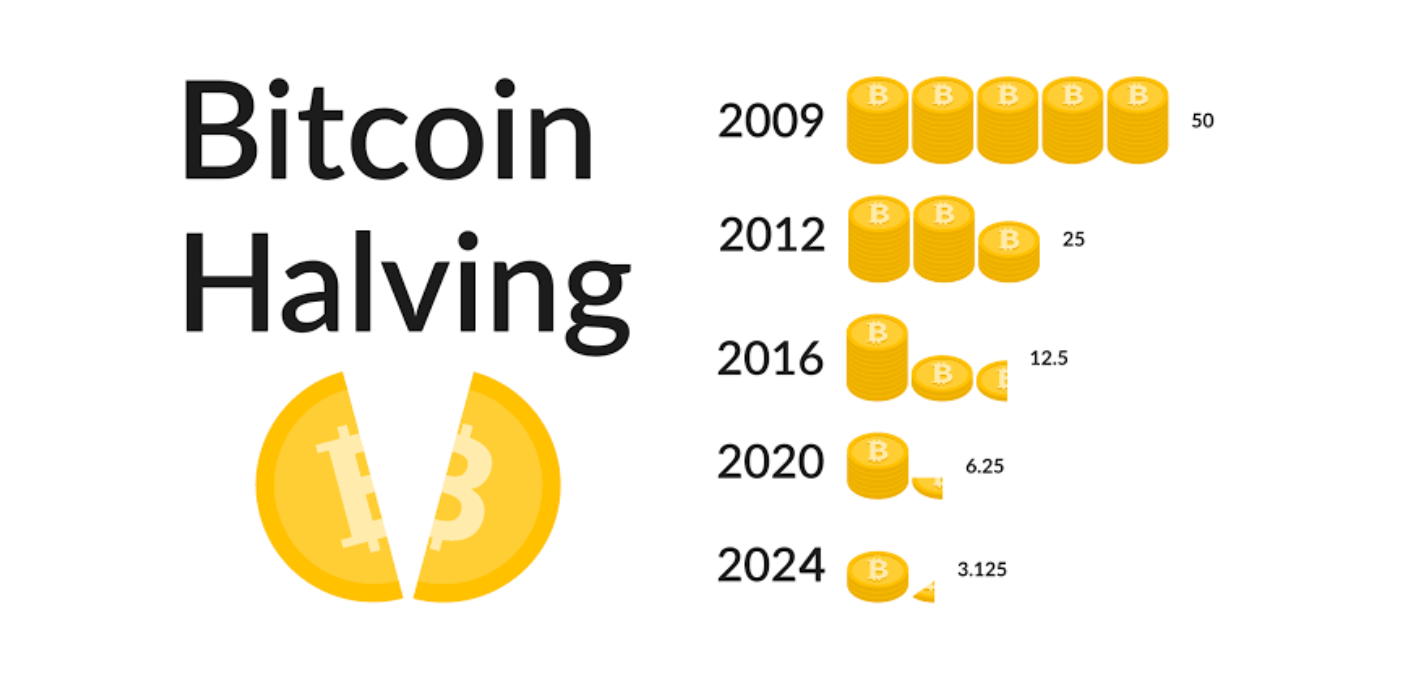

This halving event occurs when Bitcoin cuts in half the number of new bitcoins given to miners, people who help run the Bitcoin network. Just like the candy machine, miners get fewer rewards, but the system keeps running. It’s like a thrilling treasure hunt, where the rarer the prize, the more valuable it becomes with time.

The Bitcoin halving has a significant effect on the price of Bitcoin. Here’s a simplified breakdown:

- Supply and Demand: Remember our magic candy-making machine? It’s like a treasure chest that produces special candies. Every few hours, it performs the “halving” event, giving out fewer candies.

When the supply of new bitcoins is cut in half during a halving event, it reduces the rate at which new bitcoins enter circulation. This often leads to scarcity, making fewer bitcoins available for purchase. If demand remains constant or increases, the reduced supply can drive up the price of Bitcoin.

- Market psychology: Just like everyone loves candy and goes crazy for it, when the machine starts giving out fewer candies, everyone clamors more because they’re harder to get, which makes them more valuable.

The anticipation and excitement surrounding a halving event leads to increased attention from traders. This increase in interest can fuel speculative buying, driving up the price.

- Post-Halving Effects: Imagine that before the candy machine does its trick, there’s a party where everyone talks and gets excited, and then after the party, there is a quiet time when everyone gets used to the new amount of candy.

After the halving event, there may be a slight dip in price as the market adjusts to the new supply dynamics. Historically, Bitcoin has experienced a significant surge in price for months and years following each halving event.

- Long-Term Trend: Even when the machine starts giving fewer candies, the candies become more valuable over time because there are limited candies the machine can make and everyone craves some.

While halving events may cause short-term price fluctuations, the long-term trend has been upward. This is because the halving mechanism is built into Bitcoin’s protocol to decrease the rate of new supply with time, making it scarce.

Bitcoin halving is one factor among many influencing the price of Bitcoin, due to its impact on supply and demand and market psychology. Bitcoin’s price can be influenced by a wide range of factors.

Source: ShapeShit

The end.